Apr 2023

Welcome to the latest edition of our Quarterly Corporate Update covering recent developments in the British Virgin Islands.

The first quarter of 2023 saw a raft of amendments to existing BVI legislation being introduced across a number of areas. While most of these amendments are regulatory-related and not expected to have a material impact on clients, we summarise the most important ones below. It has also been a busy time on the BVI transactional front with our corporate team advising on some of the most notable transactions in the jurisdiction. Finally, the successful BVI Webinar Series concluded this month. We hope you had the opportunity to join these, but if not recordings are available on the adjacent links.

Legislative Changes

- In our last newsletter, we highlighted the new requirement to prepare an annual financial return, which was due to come into effect on 1 January 2023. The BVI Business Companies (Financial Return) Order, 2023 is now in force and explained further in this client briefing.

- The BVI Business Companies Act (the “BCA”) has been amended to impose a new duty on BVI companies to collect, maintain and keep up-to-date information on their beneficial owners, which they are required to file with their registered agents. In addition, where the beneficial owner of, or any information in relation to a beneficial owner’s interest in a company changes, the company must, within 15 days of the change, file with its registered agent information on the change. Any breach of the above requirements will constitute an offence. The BCA, as amended, also provides that companies that are already in liquidation before their first annual return becomes due do not have to file an annual financial return.

- The International Tax Authority (the “ITA”) has published updated rules on economic substance. These provide further guidance as to how the economic substance requirements may be met and include the types of evidence which the ITA will accept to support a claim of tax residence in another jurisdiction. Under the new rules, a holder of a brokerage account is not considered a pure equity holding company, as its only asset is its claim against the broker; it does not directly hold or manage equity participations since these are held by the broker. In addition, the ITA will no longer accept a letter addressed to it from lawyers or accountants stating that, in their opinion, the legal entity is considered to be resident for tax purposes in a given jurisdiction, except where the official documentation provided as evidence requires clarification. Furthermore, entities can no longer be regarded as resident for tax purposes in a jurisdiction that does not have a corporate income tax system. The rules also clarify that a legal entity in liquidation or that is being wound up must continue to comply with any applicable economic substance requirements. Any liquidators who were responsible for the entity’s liquidation must maintain the entity’s records and respond to the ITA’s information requests for a period of no less than six years from the end of the financial period in which the entity is finally dissolved.

- The Banks and Trust Companies (Amendment) Act, 2023, together with corresponding amending Acts affecting licensees under the Company Management, Financing and Money Services, Insurance and Securities and Investment Business Acts and the Regulatory Code, streamlines the definition of “significant interest” and “controlling interest” for consistency across all regulatory legislation and to ensure that all relevant components of beneficial ownership are captured. Changes to any persons who have a significant interest or a controlling interest in a licensee must be approved by the FSC and such persons must also satisfy the FSC’s fit and proper criteria. In addition, the definition of “significant interest” will now include an interest which entitles the person to appoint or remove one or more directors of the licensee. Finally, “arranging” for another person to act as a professional trustee, protector or administrator will constitute “trust business” and providing or “arranging” to provide partners, officers or similar positions or nominee shareholders will be considered “company management business”.

- The Partnership (Amendment) Act, 2023 re-enacts Part VI of the Partnership Act, Revised Edition 2020, which was inadvertently repealed in 2017, in order to govern existing limited partnerships which have not re-registered or become deemed re-registered, as a limited partnership under the Limited Partnership Act, Revised Edition 2020. The Act also expands on key requirements to keep information, books and records, including financial records and underlying documentation and a register of limited partnership interests for a period of at least 5 years after the dissolution of the limited partnership.

- The Virtual Assets Service Providers Act 2022 (the “VASP Act”) came into force on 1 February 2023. The VASP Act provides for the registration and supervision of virtual assets service providers in relation to transactions involving virtual assets; the approval of provision of virtual assets custody service; and the approval of virtual assets exchanges; and to provide for other matters connected therewith. A transitional grace period of 6 months is provided for an existing VASP to register with the BVI Financial Services Commission. Further information on the VASP Act can be found in this client briefing.

Transactions

On the transactional front, Q1 was a busy quarter for the BVI office, with our attorneys closing a number of significant deals. Among others, partner Cora Miller and counsel Nicholas Kuria advised GlobalLogic, a Hitachi Group Company operating under Hitachi, Ltd. (TSE: 6501), on its acquisition of Hexacta, a Latin American digital and data engineering firm with operations in five countries and headquartered in Uruguay.

A cross-jurisdictional team from Conyers also advised OSM Maritime Group in connection with its merger with the Thome Group. The combined company will be called OSM Thome and will manage a fleet of more than 1,000 ships. Partner Robert Briant and associate Christopher Smith worked on the matter alongside our Bermuda office.

Robert Briant, assisted by associate Oliver Cross, also acted for Atlas Air Worldwide Holdings, Inc. (“Atlas”) on BVI law aspects of the acquisition of Atlas by Rand Parent, LLC (“Rand”) and the entry into related financing arrangements including the issue by Rand of $850 million aggregate principal amount of 8.5% senior secured notes due 2030. Atlas is a leading global provider of outsourced aircraft and aviation operating services and the largest outsourced air freight provider in the world. Our Cayman Islands office provided Cayman Islands advice on the acquisition.

Finally, partner Anton Goldstein and counsel Nicholas Kuria advised Siba Energy Corporation (“Siba Energy”) on its DOP 4.1 billion project financing in respect of the financing, construction and commissioning of an approximately 252 MW combined-cycle gas fired power plant, including related sponsor arrangements. Siba Energy is a subsidiary of Empresa Generadora de Electricidad Haina, one of the largest private electricity generators in the Dominican Republic.

Additional Publications

Our attorneys also authored a number of articles covering a range of subjects impacting offshore entities and the BVI. These include articles on the growing demand for BVI hybrid funds, tax and the British Virgin Islands, key considerations for BVI companies approaching insolvency and an introduction to British Virgin Islands corporate finance.

Directory Rankings

Last but not least, Conyers’ BVI office continues to capture top rankings in all the major legal directories. The past quarter has seen us retain our Tier One ranking in Corporate and Litigation from Chambers Global and we remain top ranked by Legal 500 in Banking, Finance & Capital Markets, Corporate & Commercial, Litigation and Investment Funds. Partners Robert Briant and Anton Goldstein retained their individual Tier One rankings in Corporate and Finance while partner Richard Evans was also ranked in Tier One in Litigation.

Incorporation Statistics

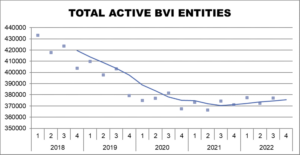

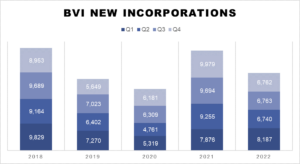

To help provide an overview of the BVI market, every quarter we provide information on the numbers of new BVI incorporations, total active BVI entities and registered investment funds. We hope they help provide a snapshot of the BVI market.

https://www.bvifsc.vg/library/publications/q4-2022-bvi-fsc-statistical-bulletin

Source: Statistical Bulletin of BVI FSC.

For more information please connect with your usual Conyers contact or one of the team members listed below.