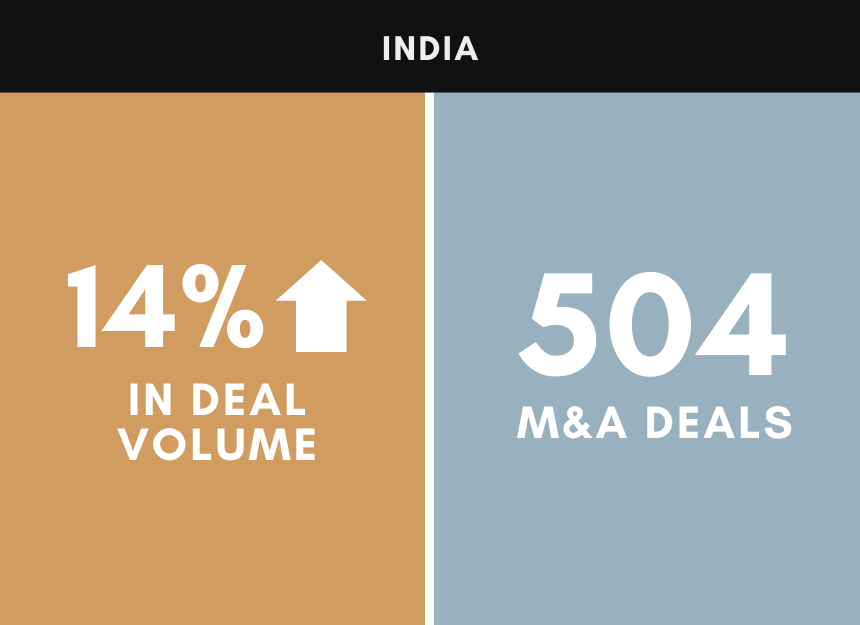

Looking ahead, India’s M&A market is expected to remain robust through late 2025, building on its strong first half. The trend toward fewer but larger transactions is expected to continue, although new U.S. tariffs on Indian exports(effective since August) may dampen cross-border activity, especially in export-driven sectors.

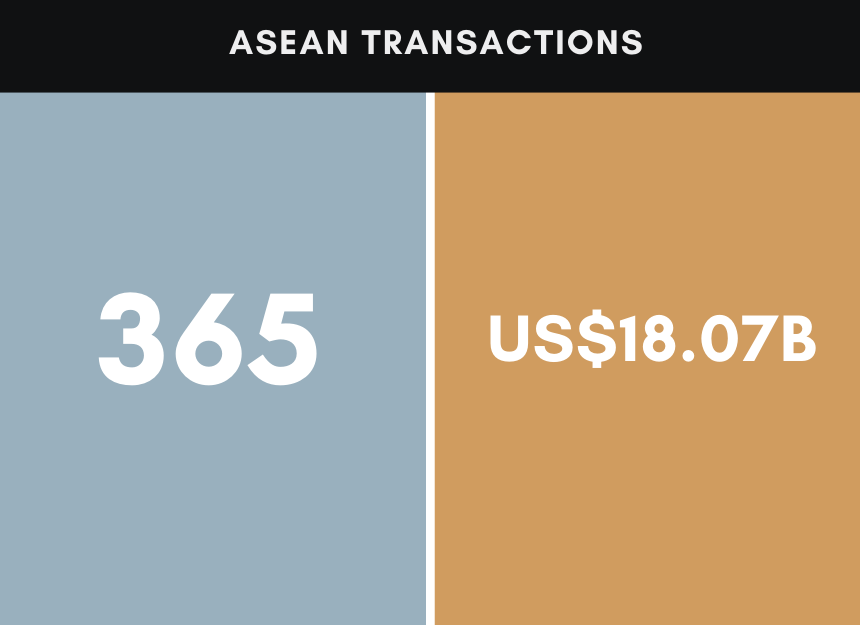

Southeast Asia is projected to experience a dynamic rebound in M&A activity driven by sectoral momentum, macroeconomic shifts, and strategic investor behaviour. With the U.S. Federal Reserve initiating rate cuts and Asian central banks expected to follow, financing costs are dropping—boosting deal volumes, and there is rising interest from Japanese, Chinese, and global multinationals, especially via Singapore.

Of course, there are always challenges to watch, including tightening regulatory complexity in some regions and sectors, and the geopolitical hurdles associated with persistent trade tensions and regional instability.