Apr 2024

Welcome to the first edition of our Quarterly Corporate Update for 2024 covering recent developments in the British Virgin Islands.

The first quarter of 2024 saw continued strong activity in the BVI office. Our corporate legal team advised on several key transactions in the jurisdiction while also assisting clients in understanding various legislative changes to company law over the previous year.

Transactions

Among the highlights, Partners Anton Goldstein and Rachael Pape advised Mexican retailer BBB Foods in connection with its US$589 million initial public offering on the New York Stock Exchange. The IPO valued BBB Foods at approximately US$2.2 billion, making it the largest BVI listing in over five years. It is also the largest IPO in the USA by a Mexico-based firm since Santander listed its Mexican unit in 2012, according to data compiled by Bloomberg. Partners Anton Goldstein and Rachael Pape together with Associate Nina Goodman advised on the transaction, working alongside Simpson Thacher & Bartlett LLP as US counsel and Greenberg Traurig, S.C. as Mexican counsel.

In addition, the team advised longstanding client Macquarie Group on a credit and guarantee agreement with NG Energy International Corp. (TSXV: GASX) (OTCQX: GASXF) for a financing of up to US$100 million of which US$50 million is committed funding. NG Energy and its wholly owned subsidiaries Bochica Investment Holdings Ltd., Pentanova BVI, Ltd. and MKMS Enerji Anonim Sirketi S.A. acted as Guarantors. Counsel Nicholas Kuria and Associate Nina Goodman advised on the transaction, working alongside Skadden, Arps, Slate, Meagher & Flom LLP, New York.

Conyers also advised Telegram Group in connection with its issuance of US$330 million bonds. Telegram Group operates the popular Telegram Messenger app, which as of March 2024 had over 900 million monthly active users. Partner Anton Goldstein and Associate Nina Goodman advised on the transaction, working alongside Skadden, Arps, Slate, Meagher & Flom (UK) LLP. Conyers previously advised Telegram Group on its issuance of US$210 million worth of bonds last year.

Last but not least, the team advised Turaco Gold Limited (ASX: TCG) on its acquisition of an initial 51% interest in Taurus Gold Afema Holdings, the 100% owner of Afema Gold SA and which holds the Afema granted mining permit in southeast Côte d’Ivoire. Turaco issued 46.5 million shares which are escrowed for 12 months and made a US$1.5 million payment to Endeavour Canada Holdings, a subsidiary of Endeavour Mining Plc. Counsel Nicholas Kuria and Associate Oliver Cross of our London office advised on the transaction, working alongside Gilbert + Tobin, Perth.

Conyers is also currently advising Nostromo Energy on an innovative transaction to take the company private and delist from the Tel Aviv Stock Exchange. The transaction will be implemented through an Israeli court approved arrangement and a BVI statutory merger. Nostromo Energy is the developer of the IceBrick® system, a virtual power plant enabled thermal energy storage solution for commercial and industrial buildings. Partner Anton Goldstein together with Counsel Nicholas Kuria and Associate Nina Goodman are advising on the transaction, working alongside Shibolet & Co. and PwC Israel.

Publications

Our attorneys continued throughout Q1 to contribute insights to several key industry publications and to produce thought leadership articles covering a range of pivotal issues and developments impacting offshore entities and the BVI. These include an article debunking tax myths about the BVI and an alert outlining updated annual return requirements for BVI companies in preparation for impending deadlines. Partner and Head of BVI Corporate, Robert Briant, and Counsel Nicholas Kuria authored the in-depth overview for Chambers and Partners’ British Virgin Islands Corporate, Finance & Investment Funds Global Guide, 2024, providing a detailed analysis of recent industry developments and key insights into anticipated trends in the coming year. Partners Rachael Pape and Matthew Brown collaborated with Watson Farley & Williams in contributing the BVI material to the new and expanded Global Aviation Resource Index (GARI), an online tool which assists users in comparing aircraft related repossession rights, deregistration rights and restructuring procedures in 100 jurisdictions worldwide.

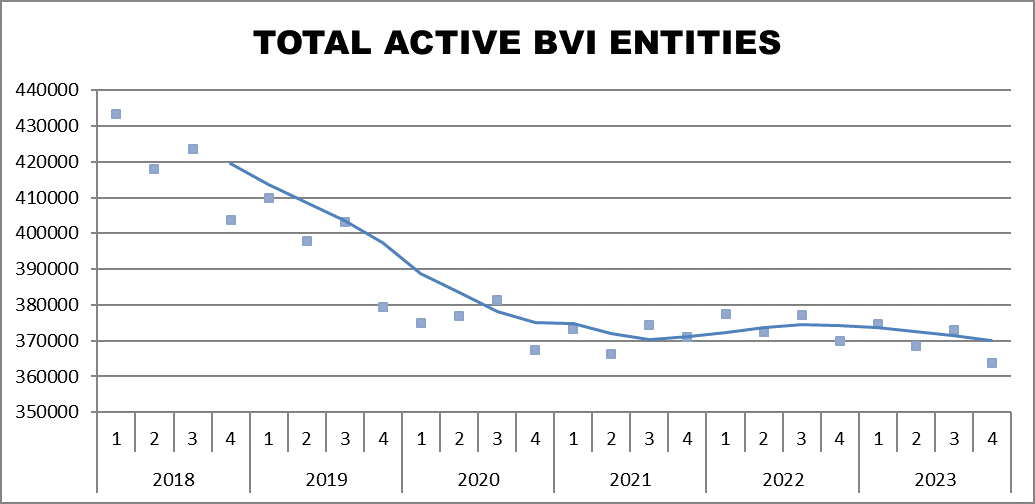

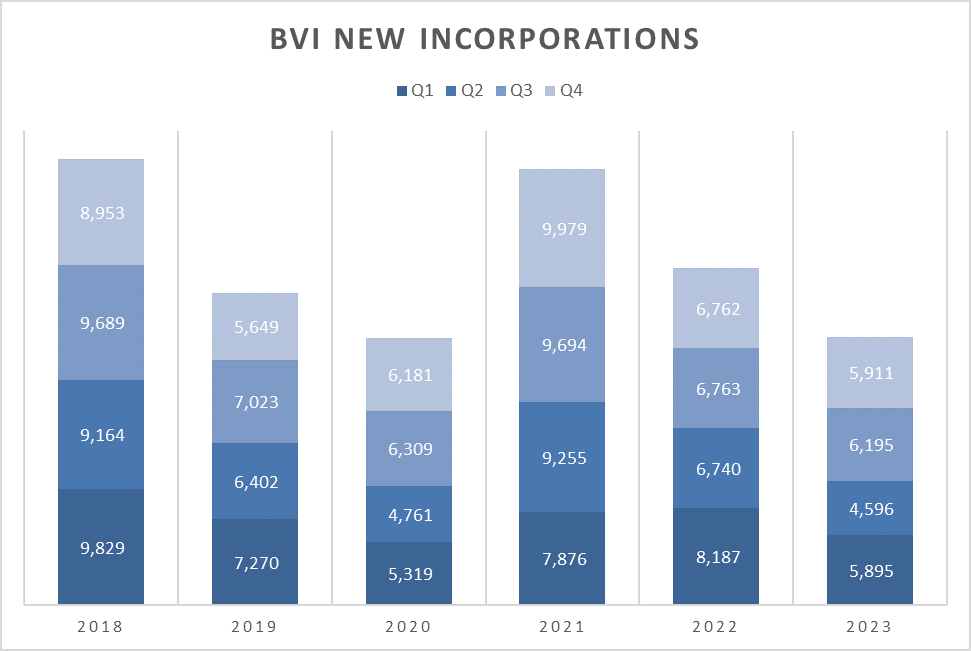

Incorporation Statistics

To help provide an overview of the BVI market, every quarter we provide information on the numbers of new BVI incorporations, total active BVI entities and registered investment funds. We hope they help provide a snapshot of the BVI market.

https://www.bvifsc.vg/sites/default/files/q4_2023_statistical_bulletin_-_final.pdf

Source: Statistical Bulletin of BVI FSC.

Source: Statistical Bulletin of BVI FSC.

*Figures for Q4 2023 are as at 31 December 2023

For more information please connect with your usual Conyers contact or one of the team members listed below.