Feb 2020

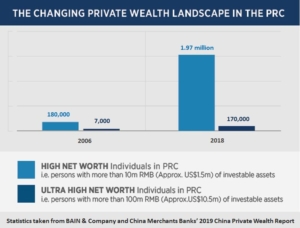

The growth and momentum of China’s billionaires appears unstoppable. In a matter of a few years, the total wealth in Asia ‒ with the People’s Republic of China (PRC) dominating the list ‒ will overtake that of the USA. This has in part been driven by an exceptional period of business for Chinese entrepreneurs. In the past decade China’s industrial sector has undergone rapid expansion. High tech manufacturing industry is now a key part of the Chinese economy and the IT and FinTech industries are growing fast. Geographically, High Net Worth individuals have spread from the traditional cities of Shanghai, Beijing, Guangdong, Jiangsu and Zhejiang to Shandong, Sichuan, Hubei and Fujian, and are continuing on to Liaoning, Henan, Tianjin, Hebei, Anhui and Hunan.

More than 80% of family enterprises in China are still controlled by the first generation of wealth creators and a massive transfer of assets to the second generation is just getting started. Affluent Chinese family leaders are no longer just focused on creating wealth; they are dealing with succession planning for their businesses and wealth inheritance. A top priority for many of them is to create an enduring shareholder structure that will preserve family ownership, frequently involving reserved-power trusts.

Private wealth generally falls into two categories. The first is hard assets in the form of the family business’ operating company and real estate, which are by far the most important assets in terms of succession planning. The second is investments and liquid assets. There are differences in how to structure the ownership of each type of assets, based on many factors such as location, access to capital, deal flow, tax efficiency, legal protection and personal safety.

Wealth planning is also triggered by a variety of life events, such as immigration, divorces, children’s education and marriages, and by business events, such as initial public offerings (IPOs). Since 2013, owing to the relaxation and simplification of rules by the China Securities Regulatory Commission, small and mid-size companies have found it easier to publicly list their businesses on overseas capital markets. The Hong Kong Stock Exchange has clearly benefited. Offshore trust planning can be very important in preparing for an IPO, when family assets and shares of the major shareholders are re-organised and formalised in a trust structure such as a BVI VISTA trust, and employee incentive benefit plans with shares and options held in trusts are put in place.

While tax is not always a principal driver for asset shelter and re-organization, the fairly recent Individual Income Tax (IIT) Reform in the PRC, which came into force in January 2019, undeniably had and continues to have a very significant impact on tax and estate planning by High Net Worth individuals. Historically, a PRC person with a permanent residence in the PRC paid PRC income tax on income earned in the PRC. The massive tax reform, amongst other things, redefined tax residence and domicile concepts to cover PRC individuals who maintain PRC household registration, vital economic interests and family ties in and to the PRC to be taxed on a worldwide basis, notwithstanding living mostly outside of the PRC. Some who have the means are actively exploring avenues to become “non-domiciles” through emigration, dual citizenships and passports and trust/nominee arrangements of certain foreign holdings to legitimately minimise that exposure. The PRC also enacted a general anti-avoidance rule (GAAR) and controlled foreign corporation (CFC) rule to tighten loopholes in China’s existing individual income tax legislation. For example, GAAR empowers the tax authorities to assess tax on individuals who are involved in transactions, such as asset transfers, which are not at arm’s length. Where tax is assessed, late payment surcharges will be applied. There is a risk that where a PRC settlor transfers or gifts assets to a trust or effects a capital contribution and/or structures an asset loan to the trust, that may trigger a taxable event that may cause the settlor and/or trustee to become liable to PRC tax. In other words, the trust assets (and trustees) may be at risk from the claims of the tax authorities. This more than ever highlights the importance of obtaining proper onshore tax and legal advice prior to offshore planning, as well as strengthening indemnities on the trustee side.

The Automatic Exchange of Information (AEOI)/Common Reporting Standard (CRS) continue to be an area of concern for HK/PRC citizens utilising offshore vehicles, given that the PRC and each of our practicing jurisdictions (Bermuda, the Cayman Islands and BVI) are signatories to these agreements. Legitimate solutions to mitigate CRS disclosures to preserve family privacy continue to be a topic of great interest.

There is also some cautious interest in using Bermuda or Cayman foundations as an alternative to trusts, given the recent adverse judicial onslaught on trust structures in the onshore courts (the infamous UK Pugachev case) and the failed but nevertheless costly attempt to erode “anti-Bartlett” provisions in the Hong Kong Court of Appeal case of Zhang Hong Li v. DBS Hong Kong (2018). A Cayman foundation, a statutory hybrid between a trust and trustee managed by a board of directors like a corporation statute, is seen by some practitioners as being free of some of the foibles and legal baggage of trust law and a better structure.

As mainland Chinese wealth has become more internationalized and the world has developed increasingly complicated rules to achieve global tax transparency, a much more nuanced, personalised and sophisticated approach to wealth management is called for. There is no “one-size fits all”. A multi-jurisdictional approach is often necessary, possibly involving different structures for different assets in different jurisdictions to provide targeted solutions to meet diverse issues.